Advanced OEMS

margin built the first dedicated cryptocurrency trading terminal back in early 2014.

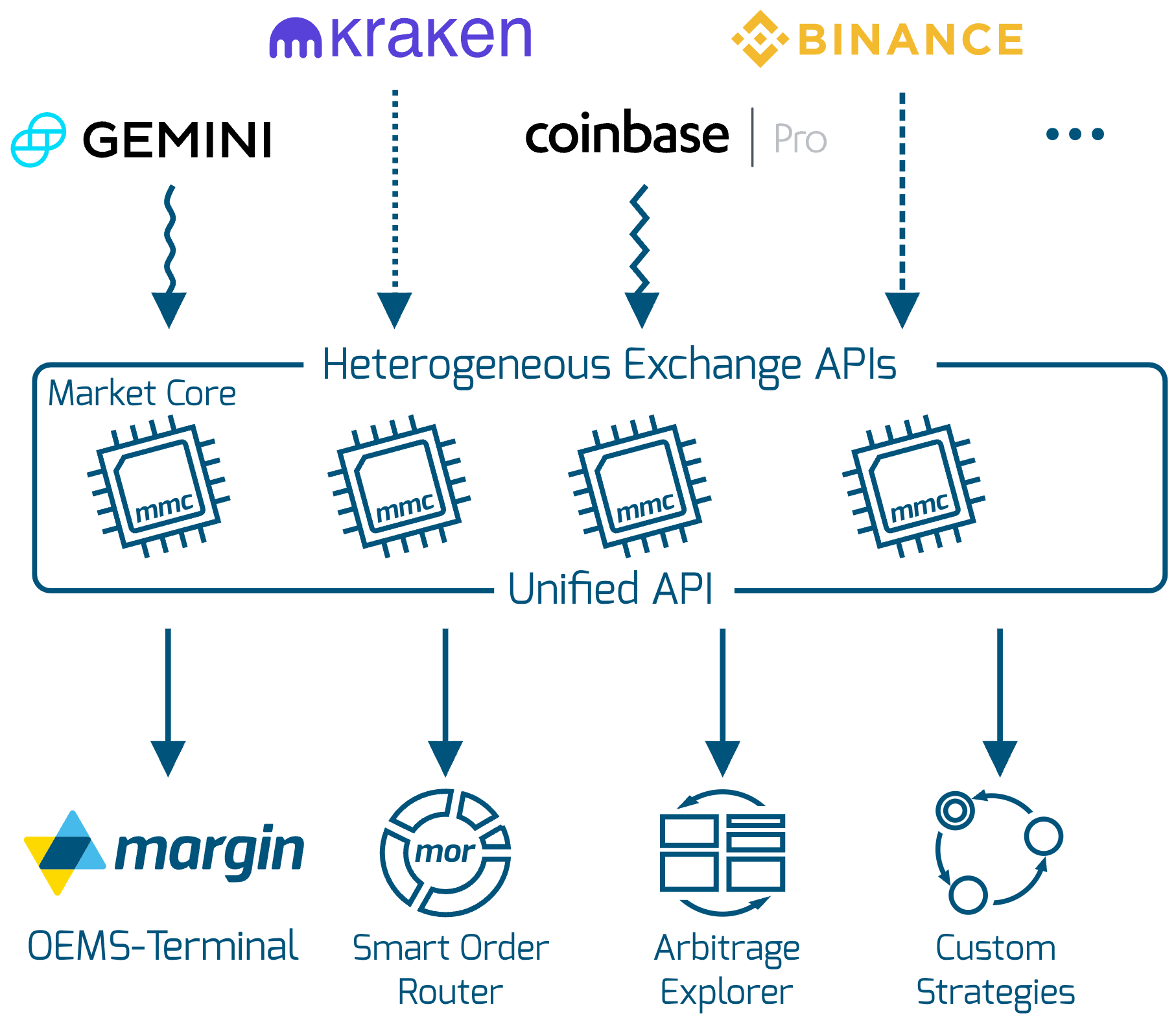

Initially we only connected to BTC-e and Bitstamp, but our idea was to have a unified

interface to multiple exchanges. The terminal is written in C++ and can be run on Windows,

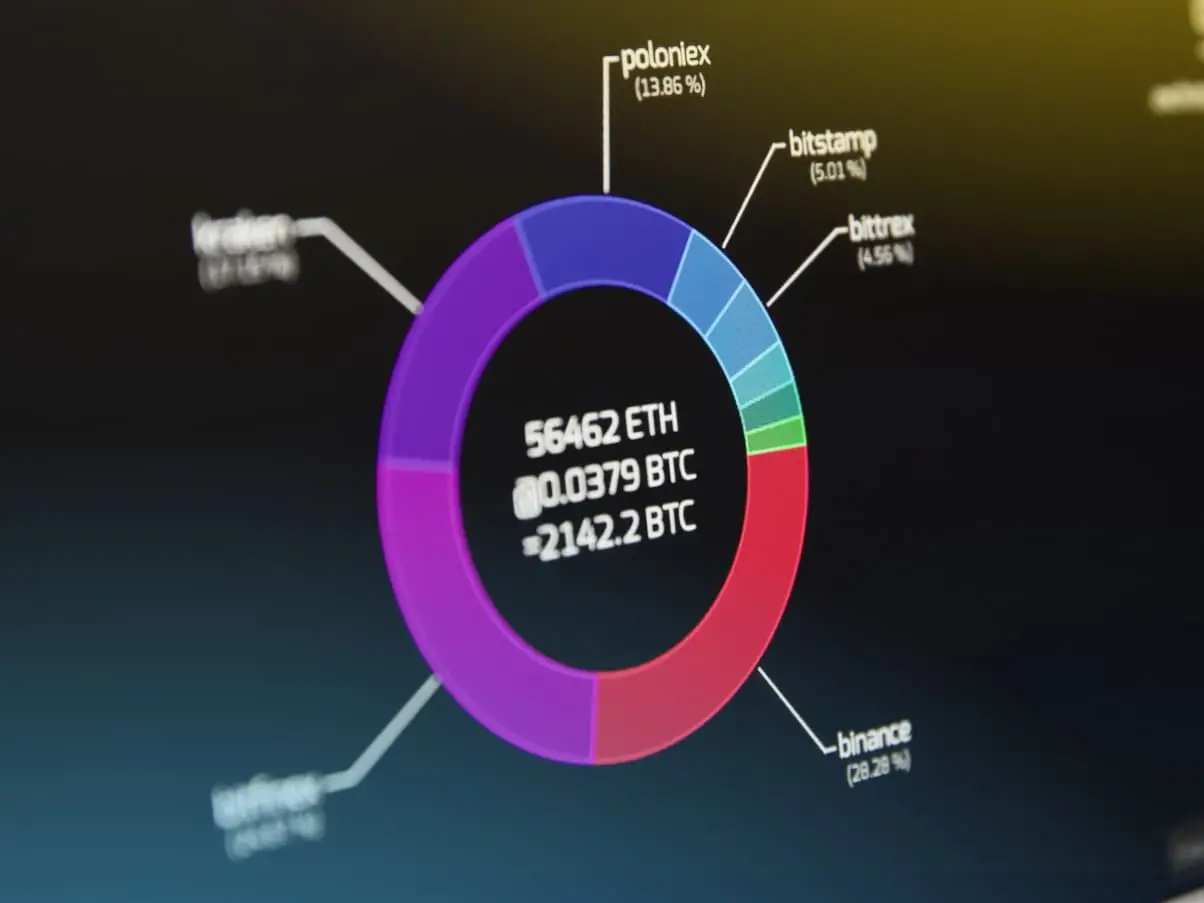

macOS and Linux. The philosophy from the start was to provide a very visual experience and to

make interaction with your orders as easy as drag n' drop. It has multi-monitor support so that

professional traders can configure their optimum setup and comes pre-loaded with technical

indicators, drawing tools, integrated twitter and Reddit feeds.